oregon wbf assessment employee

2 Employee means a subject Oregon worker as defined in ORS 656005 and any. Employers and employees split this assessment which employers collect through payroll.

Oregon Domestic Combined Payroll Tax Report Oregon Department Of Revenue Pdf Free Download

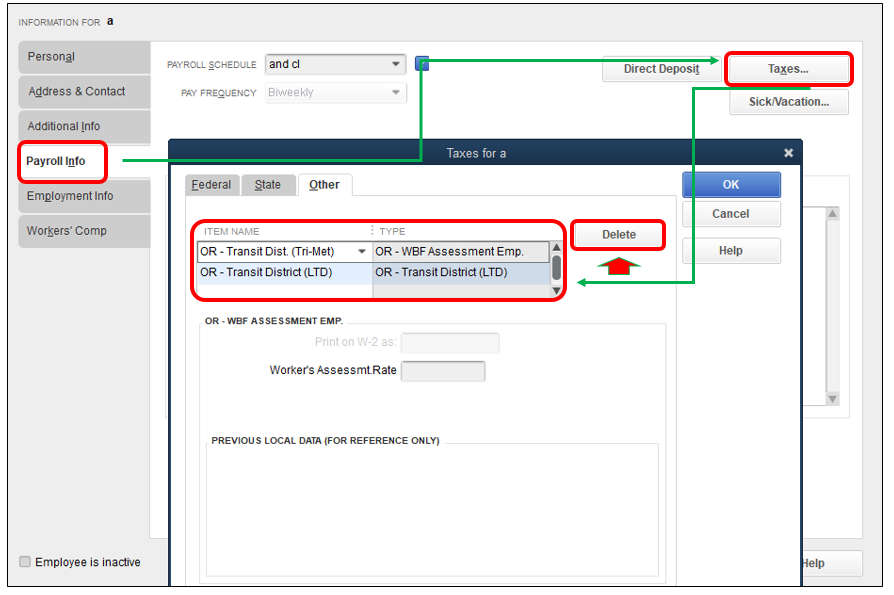

Double-click the employees name.

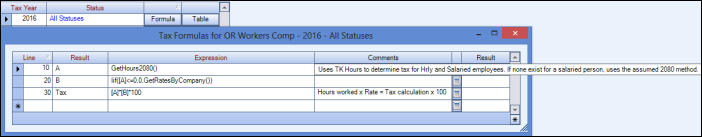

. Workers Benefit Fund WBF Assessment Definition. May 21 2019 358 pm. The Oregon Workers Benefit Fund WBF assessment is a payroll tax calculated on the number of hours worked by all paid workers.

Select the Other tab. The Workers Benefit Fund WBF assessment this is a payroll assessment calculated. Your payroll tax payments are due on the last day of the month following the end of the quarter.

If you are an Oregon employer and carry workers compensation insurance you must pay a payroll tax called the Workers Benefit Fund WBF Assessment for each employee covered under. Go to Employees then Employee Center. Oregon Workers Benefit Fund.

This assessment rate is printed in box 10 on Form OQ To. The WBF also supports Oregons highly successful programs to help injured workers return to work sooner and earn their pre-injury wages. The assessment is one part of the workers compensation insurance.

Annual domestic employers payments are due on January 31st of each year. Employers report and pay the WBF assessment directly to. Employers who employ domestic in home workers in a personal residence and pay 1000 or more in cash wages in a calendar quarter.

In Oregon employers are required to pay and report the Workers Benefit Fund WBF payroll assessment. Employers and employees split this assessment which employers collect through payroll. Workers Benefit Fund Assessment Rate Workers Benefit Fund cents-per-hour assessment.

May 21 2019 358 pm. These programs offer financial. Solution The Workers Benefit Fund WBF assessment funds return-to-work programs provides increased benefits over time for workers who are.

Select Taxes to display the Federal State and Other tabs. Tor of DCBS determines and sets the WBF assessment rate annually in compliance with requirements in ORS 656506. The Department of Consumer and Business Services has set the WBF assessment rate for calendar year 2021 at 22 cents per hour.

Oregon Workers Benefit Fund. What Is Oregon Wbf Tax. The Workers Benefit Fund WBF assessment this is a payroll assessment calculated.

1 Assessments means the funds due from employees and employers pursuant to ORS 656506. What is the Oregon WBF tax rate. The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessment is 22 cents per hour worked in 2022 unchanged.

Workers Benefit Fund Assessment Rate Workers Benefit Fund cents-per-hour assessment.

Department Of Consumer And Business Services Charts Oregon Workers Compensation Costs State Of Oregon

Oregon Employment Or Job Termination Package Us Legal Forms

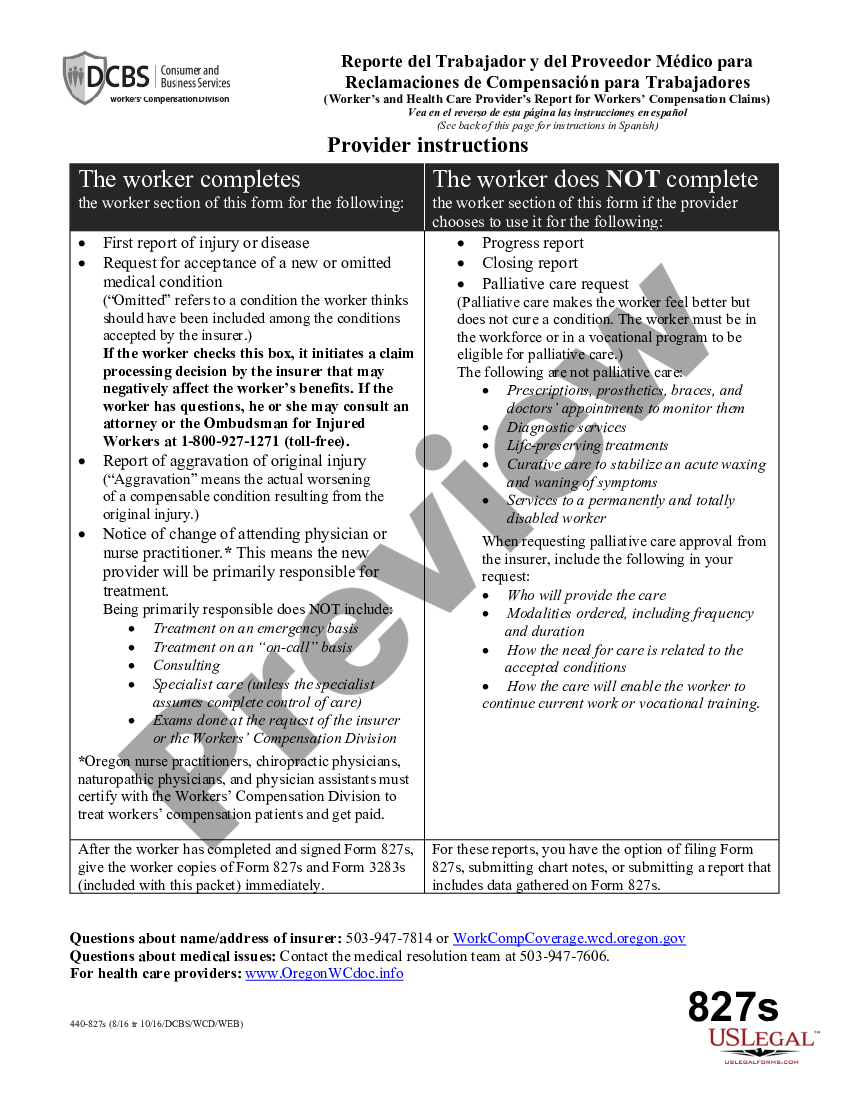

Manual For The State Of Oregon

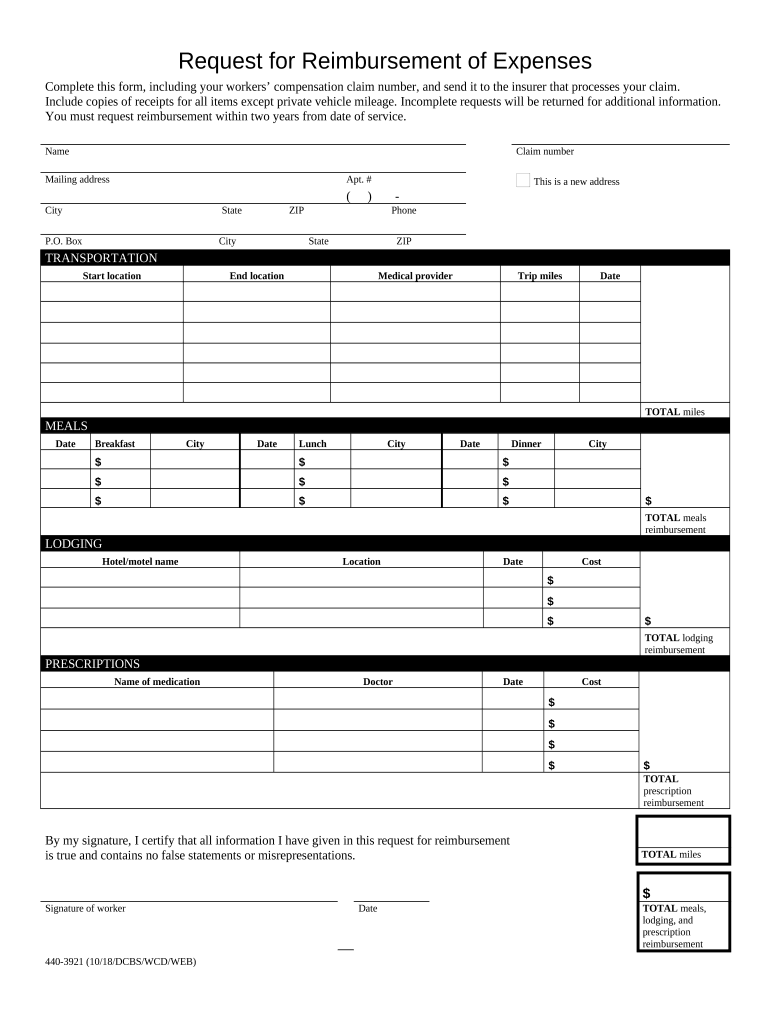

Oregon Workers Compensation Employee Withholding Us Legal Forms

Pdf Workers Compensation Analysis For Its Second Century James J Moore Academia Edu

Oregon Payroll Tax And Registration Guide Peo Guide

Oregon Domestic Combined Payroll Tax Report Oregon Department Of Revenue Pdf Free Download

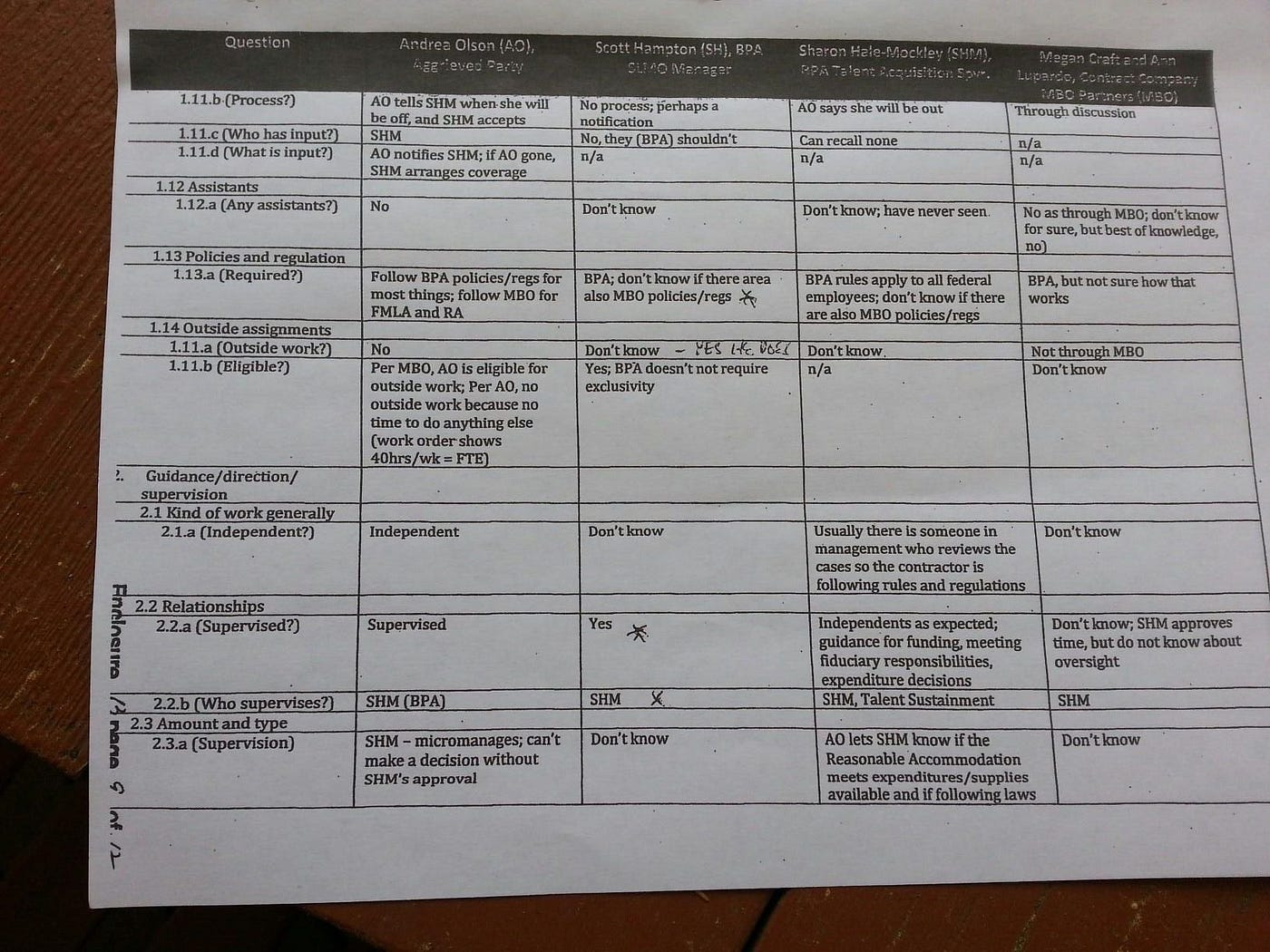

Public Comment Re Changes To Oregon S Worker Leasing Rules By Andrea Olson Medium

Oregon Workers Compensation Assessment Rate Unchanged For 2022

Bin Oregon Fill Out Printable Pdf Forms Online

Solved Transit Tax Liabilities

Guidance For The Pandemic Covid 19 Mandatory Vaccination Worker Pdf4pro

Oregon Workers Benefit Fund Payroll Tax

Oregon Nanny Tax Rules Poppins Payroll Poppins Payroll

Department Of Consumer And Business Services Charts Oregon Workers Compensation Costs State Of Oregon

Oregon Workers Compensation Employee Withholding Us Legal Forms